| IndyWatch Australian Economic News Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Australian Economic News Feed was generated at Australian News IndyWatch. |

|

Thursday, 20 July

23:36

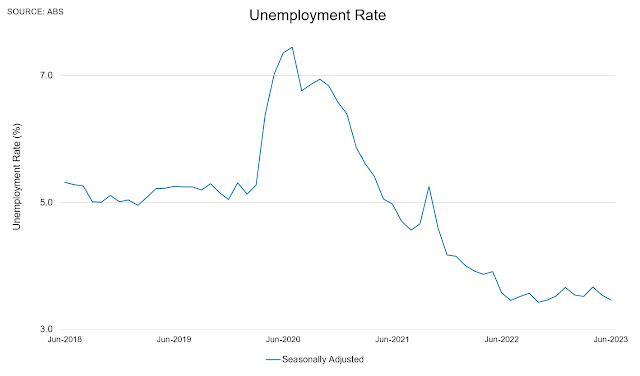

Record low unemployment rate for NSW Pete Wargent Daily Blog

Unemployment holds firm

13:18

The US$300 Trillion Hangover Daily Reckoning Australia

What are we to make of it? Is it risk on again? Is it time to load up on stocks?

The answer is no. And today we give you no-plus, the real secret to Wall Streets boom-y-ness.

Dont fight the Fed has been one of the most successful formulae on Wall Street. But its not foolproof. And not complete.

When the Fed switched from enabling inflation with zero rates in 2020to trying to curb it by increasing rates in 2022an investor would have been well advised to switch too from buying the dips to selling the bounces. Stocks went down.

Doom, gloom and boom

But then, they didnt go down. The bounce has now gone on for nine months. It has created a whole new group of rich people the AI Millionaires. And it has produced what looks to many like a new bull marketwith the best six months for the Nasdaq in historyand more to come.

Not only that, but the US economy, too, has so far resisted its long overdue rendezvous with the business cycle. Wheres the recession? Wheres all the doom & gloom we promised?

A broader question worth asking: did the geniuses at the Fed finally get the hang of managing a $24 trillion economyso that their own errors disappear, without pain or embarrassment? The Fed put interest rates far too low and left them there far too long, resulting in far too much debt throughout the world economy. What happens next? Economists argue over a hard landing or a soft landingbut what if theres no landing at? What if the party never ends?

Maybe so. But buckle your seat belts, turbulence ahead. Heres a headline story from Bloomberg: A US$500 Billion Corporate-Debt Storm Builds Over Global Economy:

Fears of a credit crisis have receded. But a wave of corporate bankruptcies is building now that an era of easy money has come to an end.

And heres another: The US$785 Billion Junk-Bond Maturity Wall Has Never Been So Close:

The worlds riskiest borrowers are starting to run out of easy-money era financing and feeling the pinch as they return to a tougher market shadowed by aggressive central banks.

Junk-rated companies staring down a US$785 billion maturity wall are in a race against time to replace debt that they secured when major central banks across the world slashed rates and boosted quantitative easing programs to keep economies afloat in 2020. On average, these companies now have 4.7 years to put fresh financing in place, the least amount of time ever, according to a Bloomberg global index.

...

13:17

Its a Dark Club and You Dont Want a Part in It! Daily Reckoning Australia

In November 2005, George Carlin said to his audience in a New York live show Life is Worth Losing that Its a big club and you aint in it. This statement will be what people will remember him for in future generations.

He revealed the shocking truth about the system that we live in.

You can hear a four-minute excerpt here.

A word of warning though theres some confronting and shocking content in this clip. Just so you know, the swearing is the least of the matter!

You know that theres a bunch of people who own most of the worlds resources, companies and wield an immense amount of power. Ive talked about this in the past on several occasions (like here).

Theyre not as invincible as they used to be after the arrest and mysterious suicide of Jeffrey Epstein in 2019. And, more prominently, when they lost control of Twitter last October, hence the power to control the narrative.

In fact, the latest bombshell is profoundly destructive to them. So much so that its sealed their fate.

Ive primed you in the past to stomach whats to come.

Here goes

Buckle up, this one is dark

Exploiting the most vulnerable

The Sound of Freedom is a movie detailing the true story of Tim Ballard, a US Department of Homeland Security agent who fought for over a decade to rescue children from international crime syndicates engaging in sex slavery and human trafficking. Released on 4 July in line with Independence Day, it caused much controversy and division.

The controversy wasnt over how such heinous acts existed in the world. After all, people have grown aware of this going on in their own country.

For example, the Hong Kong public found out last year how gangs tricked tourists to fly to South-East Asia before selling them to slave labour. This prompted calls for the Special Administrative Government to tighten laws to protect people from falling into these traps. They also imposed severe punishments against offenders who were caught.

In January this year, the singer Madonna was in the headlines after a charity foundation, Ethiopian World Federation, accused her of engaging in child trafficking in Malawi. The singer has been a prominent philanthropist supporting child adoption in Africa. She has personally adopted four African children to raise as her own. However, in doing so, she raised...

12:33

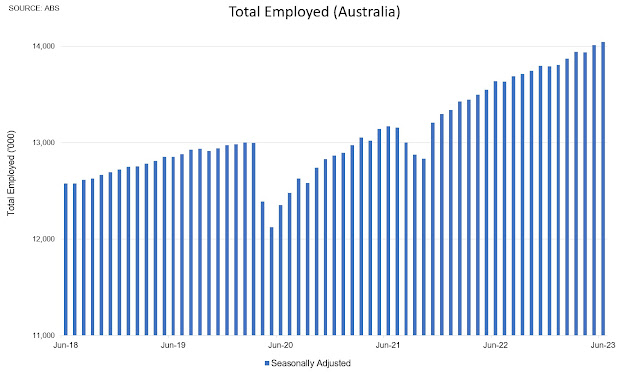

Australian labour market unemployment remains at 3.5 per cent yet inflation continues to fall how can the NAIRU be 4.5 per cent? William Mitchell Modern Monetary Theory

The Australian Bureau of Statistics (ABS) released of the latest labour force data today (June 15, 2023) Labour Force, Australia for June 2023. The June result presents a relatively stable picture with moderate employment growth keeping pace with the underlying population growth and the unemployment rate being largely unchanged (a slight drop in

05:14

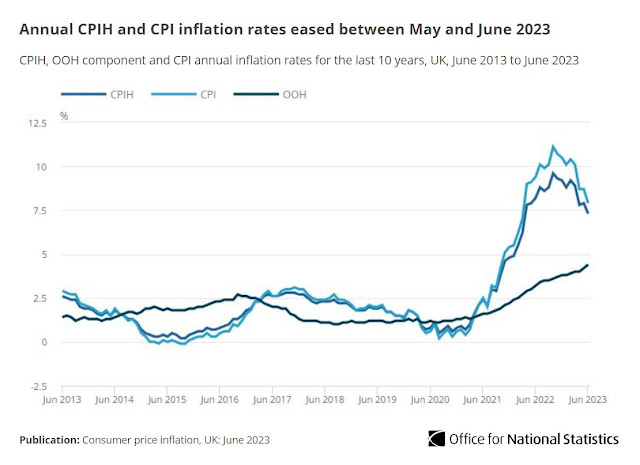

Bank of England breathes a sigh of relief Pete Wargent Daily Blog

03:26

Chinese E-retailer Temu Files Lawsuit in US Against Rival Shein, Alleging Antitrust Violations Pacific Money The Diplomat

Temu is alleging that Shein, a rival company also of Chinese origin, has compelled clothing manufacturers to submit to unfair supply chain arrangements preventing them from working with Temu.

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Wednesday, 19 July

18:19

RBA interest rate rises are inflationary and neoliberal privatisations have reinforced that William Mitchell Modern Monetary Theory

Modern Monetary Theory (MMT) economists have argued from the outset that using interest rate rises to subdue inflationary pressures may in fact add to those pressures through their impact on business costs. Businesses with outstanding trade credit or overdrafts will use their market power to pass the higher borrowing costs on to consumers. In more

16:42

Concerns over slow progress of Global Pandemic Agreement amid splintering of discussions AFTINET

July 19, 2023: Global Pandemic Agreement discussions aimed at ensuring equitable access to medicines in the case of a future global health emergency have resumed this week at the World Health Organisation (WHO).

The agreement aims to avoid a repeat of the "catastrophic moral failure" of the Covid pandemic, when delaying tactics by a few high-income countries meant it took 20 months for members of the WTO to agree to a change to patent rules for COVID vaccines to allow for more equitable vaccine distribution. A watered-down agreement was only reached in June 2022, by which time research shows that over a million lives may have been lost through lack of access to vaccines.

An early draft of the Global Pandemic Agreement included a commitment to reserve up to 20% of any tests, vaccines or treatments for low-income countries in a future global health emergency but negotiations so far have been slow and fraught. Tensions between low-income countries, arguing for more equitable medicine access, and high-income countries seeking to protect the interests of their pharmaceutical companies have continued.

Efforts by the negotiators to create a more concise initial draft has been met with backlash over the perceived influence of high income countries in the weakening of initial commitments to health equity.

AFTINET, civil society groups and public health experts have called for the Global Pandemic Agreement to include:

- Temporary waivers of WTO rules on patent and other intellectual property rights to enable global medicines production at affordable prices for low-income countries;

- The incentivisation of transfer of manufacturing technology for pandemic-related products in low and middle-income countries;

- Public funding for research and development of pandemic-related products to be made conditional on open licensing and sharing of intellectual property, technology and know-how, and include terms and conditions in contracts related to prices of products.

...

13:31

Australias financial regulator cancels license for FTXs local entity "IndyWatch Feed Crypto"

ASIC had previously suspended FTXs license to operate in Australia; now the securities regulator has canceled it entirely.

07:59

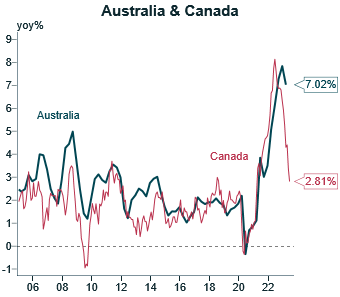

Canada's inflation falls to 27-month low Pete Wargent Daily Blog

07:31

What's driving the surge in property listings? Pete Wargent Daily Blog

07:13

How Indonesia Manages the Risks of Foreign Investment Pacific Money The Diplomat

Diversification of investment partners has been the key to the strategy pursued by President Joko Widodo's administration.

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Tuesday, 18 July

23:18

Post-pandemic Principle #5: Understanding your most valuable asset of all Pete Wargent Daily Blog

Post-pandemic principles

In this short blog post and video, I look at the 5th post-pandemic principle, as the next part in this mini-series.

Tune in here (or click on the image below):

---

Reuters reported today that LendLease is looking to shed 10 per cent of its 7,800-strong global workforce, as part of a plan to 'rightsize' its workforce and focus on lower-risk projects.

Bond yields took a turn lower through the day.

17:21

Monday Message Board (running late) John Quiggin

Post comments on any topic. Civil discussion and no coarse language please. Side discussions and idees fixes to the sandpits, please.

Im now using Substack as a blogging platform, and for my monthly email newsletter. For the moment, Ill post both at this blog and on Substack. You can also follow me on Mastodon here.

13:10

Borrow, Print, Repeat Daily Reckoning Australia

Previously, weve looked too at what the feds have to push with carrots and sticks and the way the two political parties have come together to get more of them.

But the carrots are running out. The US has added US$27 trillion to its debt so far this centuryUS$1 trillion in the last five weeks. Thats money it spentbut didnt have.

And now the Fed is trapped between inflate or die. It must now continue to inflate its economyor its bubble economy will die.

But waitthe headlines tell us that inflation is beaten.

CNN: Inflation fever is finally breaking. The Feds soft landing may be in sight:

If Fed Chair Jerome Powell were any less buttoned up, hed be well within his rights to call a press conference, stride up to the lectern in a t-shirt and board shorts and say three words soft landing, jerks! before dropping the mic and walking out.

For context, a year ago the CPI peaked at 9.1% the worst inflation in more than 40 years. [Now, its half that level.]

That is, to be clear, fan-freakin-tastic.

(For the record, the Fed has a 2% target for inflation. And while the CPI gets more headlines, central bank officials favour a different inflation gauge, the Personal Consumption Expenditures price index. The most recent core PCE index reading was 4.6% in May.)

For the record, in other words, it isnt so fan-freakin-tastic after all.

Up, up and away

Inflation is 130% above the Feds target. Prices are far higher than they were two years agoand theyre still going up.

Inflation is always and everywhere a political phenomenon. And if the Feds continue to spend trillions of dollars more than they receive in taxesthey will have to get the money somewhere. Either borrowing or printing. Borrowing pushes up interest rates and crimps the economy leading to lower tax receipts and the need to borrow even more. That leaves only two real choicescutting back on spending or inflating the currency.

But budget cuts run into the brick wall of the US late, degenerate political system. Everybody wants more. Nobody wants less. Republicans no longer oppose the carrots. Democrats no longer abhor the sticks. Instead, the elite of both parties want more of both.

So, inflation is not going away. The Feds will print. And the money will lose value almost as fast as it is created. That is the lesson from countless experiments with overspending and printing press money. There is no reason to expect a different outcome this time.

The road to ruin

But its not just the money. There are two major ways to destroy a great nation inflation and war. Thats where the sticks become deadly. And last week, the US showed up in Vilnius with a...

13:10

First the Crescendo, Then the Collapse Daily Reckoning Australia

BusinessWeeks cover story in August 1979, wasThe Death of EquitiesHow Inflation is destroying the stock market.

|

|

|

Source: Business Week |

With hindsight, we can have a little chuckle at the premature reading of the markets last rites. However, the cover story is a simple, but highly effective example of social mood.

Most people dont realise that by August 1979, the US market (S&P 500) had gone nowhere for more than a decade.

Investors had been ground down and could see no end in sight to this misery.

And, as the chart shows, after August 1979, investor despair continued for another three yearsfinally bottoming out in 1982

|

|

|

Sou... |

12:08

Australian petroleum lobby advertisement banned over 'cleaner' natural gas claim "IndyWatch Feed Economics"

A rare penalty for misleading environmental claims has seen a television commercial for Australia's petroleum association cut from the airwaves.

11:30

Why Indonesia Should be Cautious in Extending its High-Speed Railway Pacific Money The Diplomat

The eastward extension to Surabaya may make economic sense, but Jakarta should first learn from the troubles faced during the construction of the Jakarta-Bandung line.

02:59

Growth in Australian construction costs lowest since 2020 Pete Wargent Daily Blog

Monday, 17 July

18:09

National Australia Bank joins crypto exchange boycott, cites scams "IndyWatch Feed Crypto"

National Australia Bank is the latest bank to announce blocks on certain cryptocurrency exchanges, citing the high risk of scams.